The norm & the Facetime buyers

With start-of-year uncertainty now behind us the Sydney property market found its ‘normal’ groove this month. That is, if you don’t count the penthouse that sold via Facetime for $3.4 million.

Statement homes always seem to magnify these anomalies, and Sydney’s love for warehouses was felt strongly here. It lured the interstate buyers for this Griffiths Tea warehouse out of the ether (inspecting via video phone) and they secured it sight unseen.

The market continued to show strength in similar luxury price points in Paddington. This home at 9 Goodhope Street was one of the most popular properties of the month.

More than 134 groups inspected the underdeveloped home on nearly 250sqm with an 11.7m frontage. Listed for $3.5 million, seven registered bidders stretched that price expectation.

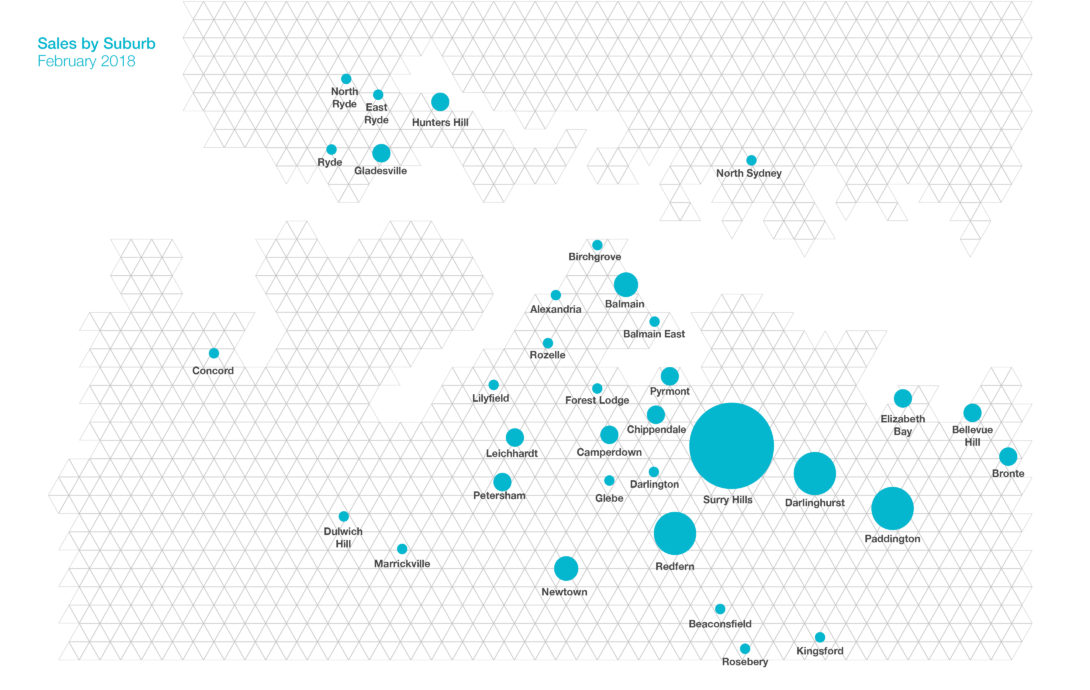

Across a variety of process and brackets the number of transactions was strong with 69 sales for February. After an exaggerated number of buyers per property at the start of the year, we’re seeing around 12 groups at each open inspection, up on the 8 people we were seeing near the end of last year.

With more stock hitting the market, keep an eye on these attendance levels as one indicator of buoyancy. In the absence of obvious price movements, transaction volumes and clearance rates become more practical.

Sales were concentrated on city precincts from Surry Hills to Newtown, with strong results also seen for high-end family homes from Bronte to Rosebery.

Numbers have increased through rental property open homes. However, tenants want value and are only tempted with refreshed and well-maintained properties. It’s not a new trend, but with more properties to choose from, it seems to be becoming more important to homehunters.

It’s ‘peak’ season. But where we used to see 20+ groups and bidding for rental properties, we’re now seeing an average of around 6 discerning groups.