Sydney property market surges again

Our property market has been surging ahead recently, but last month brought another monumental shift.

Sydney property prices lifted 1.7% in February alone with the national index likely to reach a new nominal high in the next two months.

According to CoreLogic’s Hedonic Home Value Index, we’re just 1.2% below the 2017 peak before prices started to decline. And Sydney was the best performer of all capital cities in the last quarter, up 4.6%.

“The primary factors driving this rebound remain in place and include an extremely low cost of debt and improved borrowing capacity,” CoreLogic’s head of research Tim Lawless said.

“However, considering the sluggish pace of household income growth, housing affordability is eroding rapidly which is likely to see some parts of the market become less active.”

The most expensive end of the market has seen the strongest performance driven by a rise in borrowing capacity following changes to serviceability assessment from APRA in July 2019 and the dominance of owner occupier buyers.

“With lenders favouring ‘high quality’ borrowers, buyers with a large deposit and low level of debt relative to their incomes, are likely to be those who receive the lowest mortgage rates – another factor that could be supporting demand at the more expensive end of the market,” Lawless said.

At BresicWhitney, it delivered the biggest week of sales volume for 2020, with our vendors selling $51 million in property in the last week of February. We sold 79 homes for the month, with around 14% of them transacting off-market.

At the same time, we scheduled 74 auctions for March with sellers capitalising on our buyer demand that has been delivering them an average of 15 groups to each open home.

With the government moving to stimulate the economy amid the bushfire aftermath and Coronavirus concerns, yesterday’s rate cut should also be popular with buyers. The RBA slashed the cash rate by 25 basis points to new record low of 0.5%.

On the front lines, we’ve seen impressive results from pre-qualified home hunters within our network.

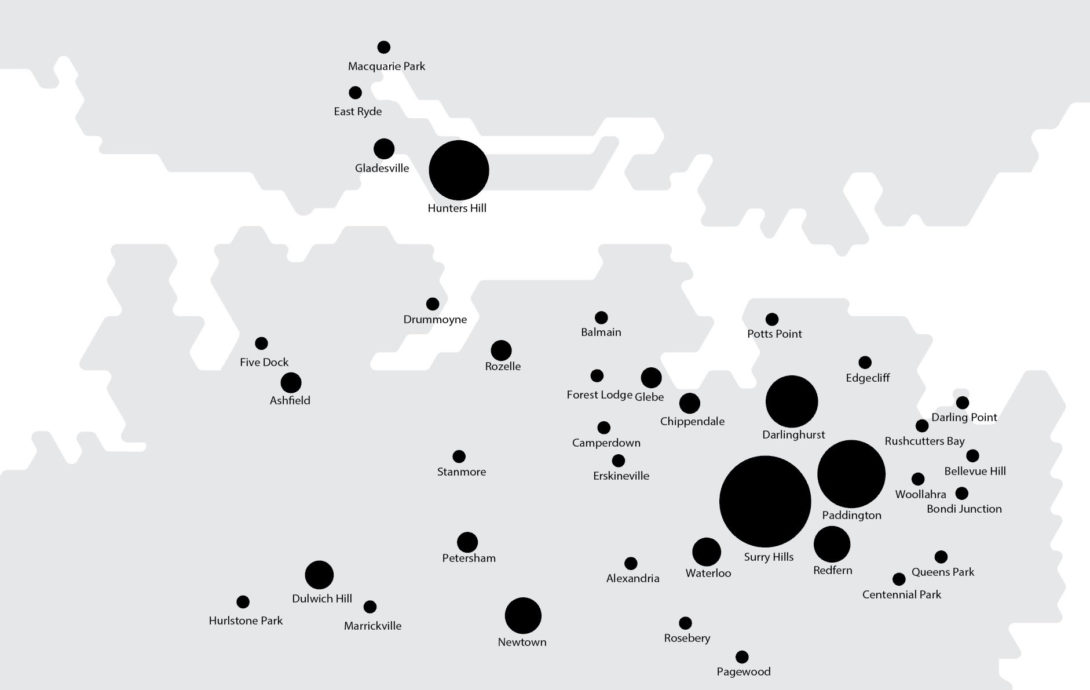

In Hunters Hill, we had multiple off-market transactions and sales above $4 million.

One BW agent mentioned 23 Chapman Street, Surry Hills to a colleague, and she produced a buyer from Paddington for it the next day, selling for $1.38 million.

Another agent had 50 groups who missed a quick sale. She sent them to a colleague’s listing at 17 Young Street, Redfern and her direct underbidder brought a new dynamic to the auction day, selling for $2.475 million.

2/35-41 Mallett Street, Camperdown was one of our busier campaigns of 2020, selling $140,000 above reserve for $1.69 million, with 200 groups through, and 11 registering to bid. We saw similar scenes at 6/3 Queen Street, Chippendale, which sold for $1.77 million in front of 17 registered bidders.

Five people bid at 34 Ashton Street, Queens Park, even though one pre-qualified buyer wasn’t considering Queens Park, selling for $3.711 million. 13 Moore Park Road, Centennial Park sold off-market around $4 million to a buyer the team had been helping hunt for a year.

And 160 Queen Street, Woollahra fetched $3.085 million after a better house two doors down sold elsewhere in December for $2.8 million.

Our clearance rate for February was 95% with plenty of homes selling prior to auction day.

The BresicWhitney network brought a high number of personally-introduced sales including a Hunters Hill buyer jumping into Balmain, and Eastern Suburbs buyers heading for the Inner West.

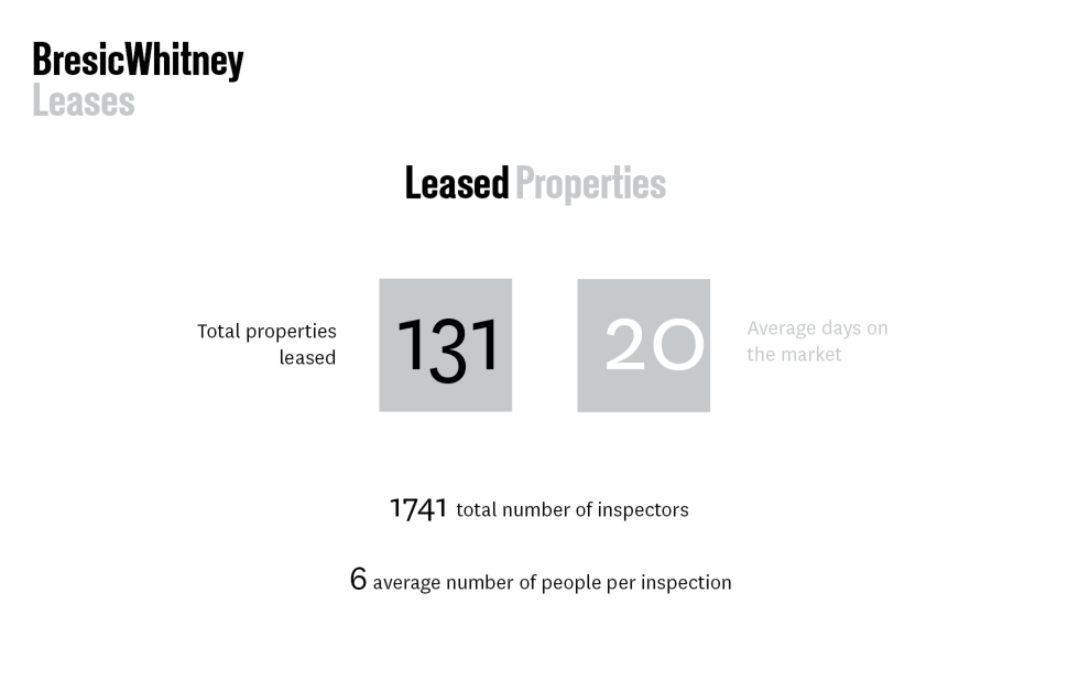

Our property management people have enjoyed a strong start to 2020, leasing 101 properties in January and 131 properties in February. Open home attendance is up on last year, almost three times healthier than November.

This new demand on some properties has meant higher offers from some tenants. One example was 40 Taylor Street, Darlinghurst, with 15 groups at one open home, and $50pw offered above the asking price.

This new demand on some properties has meant higher offers from some tenants. One example was 40 Taylor Street, Darlinghurst, with 15 groups at one open home, and $50pw offered above the asking price.

Still, accurate pricing is critical with some properties online for longer, and tenants having unforgiving mindsets if prices are too high.