Some positivity for Sydney property

The air of positivity continues for Sydney property in this post-election market, with all eyes on auction results from this past weekend.

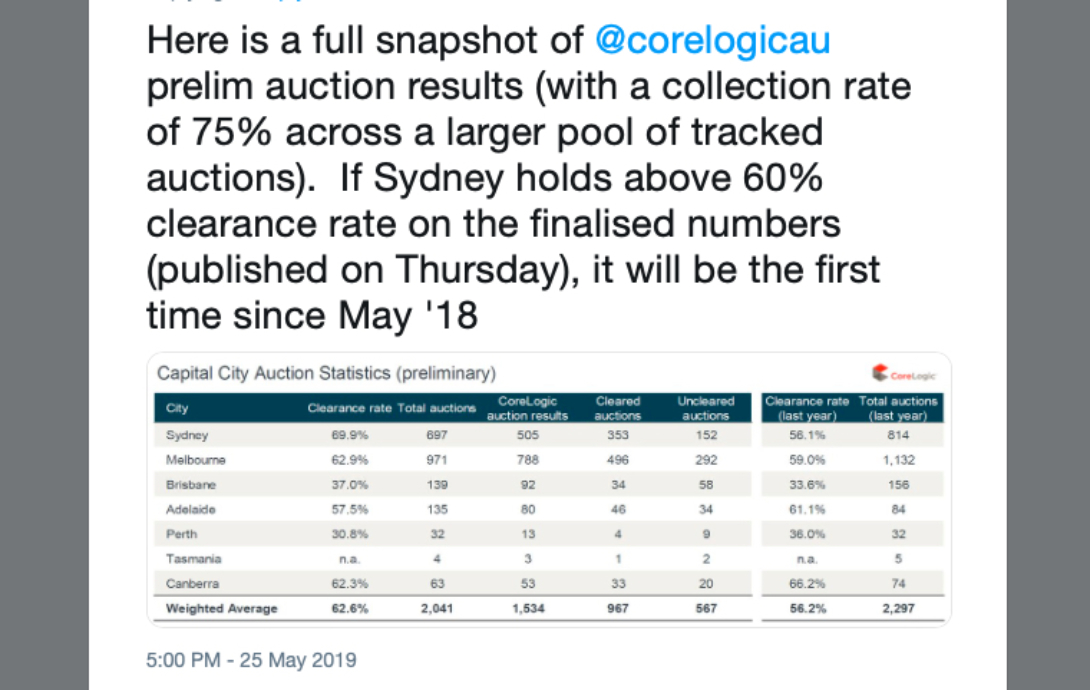

Executive director Tim Lawless from data group CoreLogic was quick to draw attention to the healthier auction clearance rates.

He tweeted a snapshot of preliminary auction results, showing Sydney sitting at 69.9%. If Sydney holds above 60% clearance rate on the finalised numbers, it will be the first time that has happened since May 2018. Those results will be published Thursday.

It comes with a spike in activity that saw Sydney host 697 auctions compared with just 276 a week earlier (the slowdown of election weekend).

The major change our buyers and sellers are looking at is the Australian Prudential Regulation Authority recommendation that banks reduce serviceability buffers. APRA proposed scrapping the 7% test, in good news for borrowers. Introduced in December 2014, is was a way of tempering a runaway housing market at the time.

It requires banks to assess all home loans against a floor of 7%, or 2% above the rate paid by the borrower, whichever is higher.

CoreLogic’s Kevin Brogan told AFR on Sunday: “The continuity of negative gearing and capital gains tax concessions for investors, the proposed change to the APRA serviceability buffer and the likelihood of an imminent reduction(s) in interest rates would all be expected to have a stimulatory effect on the residential property market.

”In the longer term, the first-time homebuyers deposit scheme will also have an effect. Lenders will still be focusing on household expenditure and serviceability criteria.”

The regulator has begun consulting with banks on removing the 7% floor, while reportedly retaining a 2% buffer, raising it to 2.5%.

The changes are expected to increase borrowing capacity, while maintaining sound lending practices.

We can report the energy is up at BresicWhitney opens, but it’s all reactionary chatter for now. The committed buyers we know remain levelheaded, with their optimism in check.

To discuss an approach for selling in this market, just ask.