May prices dip, as positive signs start to show

Sydney home prices dipped in May down 0.4% on the CoreLogic numbers, but there was some positivity to be found.

On the front lines at BresicWhitney that came in behaviour we saw from buyers. Wherever people saw value, one or two buyers would step in and push through for a result.

In other hopeful signs, buyer numbers are back and trending upwards again. The average attendees per open is now up to 11 per inspection.

The BresicWhitney team sold 59 properties in May, including 14 off-market sales. Evidence of buyers reacting to value came at 398 Annandale Street, Annandale with Chris Nunn. When the guide was $3.7 million, no one wanted to act first, even below that price. With the property online for several weeks the guide was dropped to $3.5 million. The original contenders acted at the same time, competing to $3.8 million, a $100,000 premium on original guide.

Evidence of buyers reacting to value came at 398 Annandale Street, Annandale with Chris Nunn. When the guide was $3.7 million, no one wanted to act first, even below that price. With the property online for several weeks the guide was dropped to $3.5 million. The original contenders acted at the same time, competing to $3.8 million, a $100,000 premium on original guide.

Adrian Oddi had a similar scene at 9/65-69 Nelson Street, Rozelle where the guide was $1.2 million, and offers were around $1 million. With a guide dropped to $1.1 million, it activated the local market, engaging 3 buyers, and selling for $1.18 million.

We also had buyers competing off-market and setting a ‘street record’ at 54 Dillon Street, Paddington, sold for $3 million with Maclay Longhurst.

With fewer buyers, smart presentation was as powerful as good pricing. Luke Grosvenor had a terrace at 3 Hordern Street, Newtown going slowly at $1.1 million. After advising new carpet, new paint, and styling (around $16,000 spent), it had 80 inspections in two weeks, selling for $1.4 million.

Sales were concentrated around the Eastern Suburbs, Balmain region, and Hunters Hill, with further activity in the Inner West.

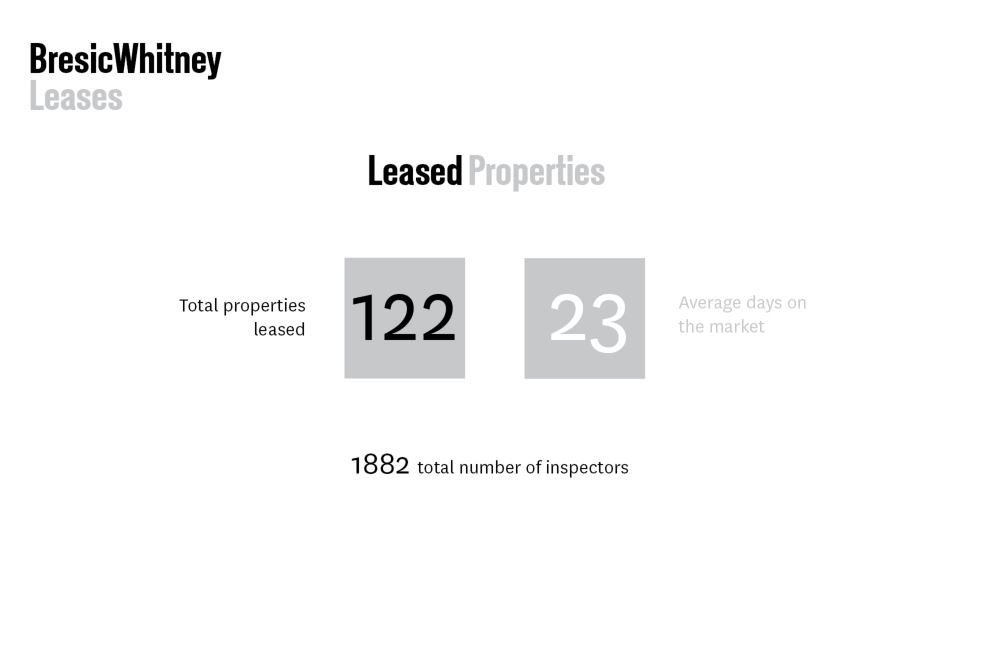

In the rental space, pricing and presentation is everything and owners need to weigh up extended vacancy periods over savvy pricing.

One example of this was at 2/50-54 Ann Street, Surry Hills, which saw plenty of inquiry and leased at $985pw at the first open. It was tempting to advertise at $1100pw, inline with a competing offering in the building, but that home spent weeks without a tenant, before also being discounted to match our pricing.

That’s the reality. And owners need to stay ahead of the competition.

With many COVID restrictions now lifted, we’re still seeing mixed numbers at open homes. Vacancy rates improved slightly this week from 7% to 6.5% and it was the second week in a row we saw diminished numbers of people wanting to vacate.