Market Report: rent rises & a new era for property?

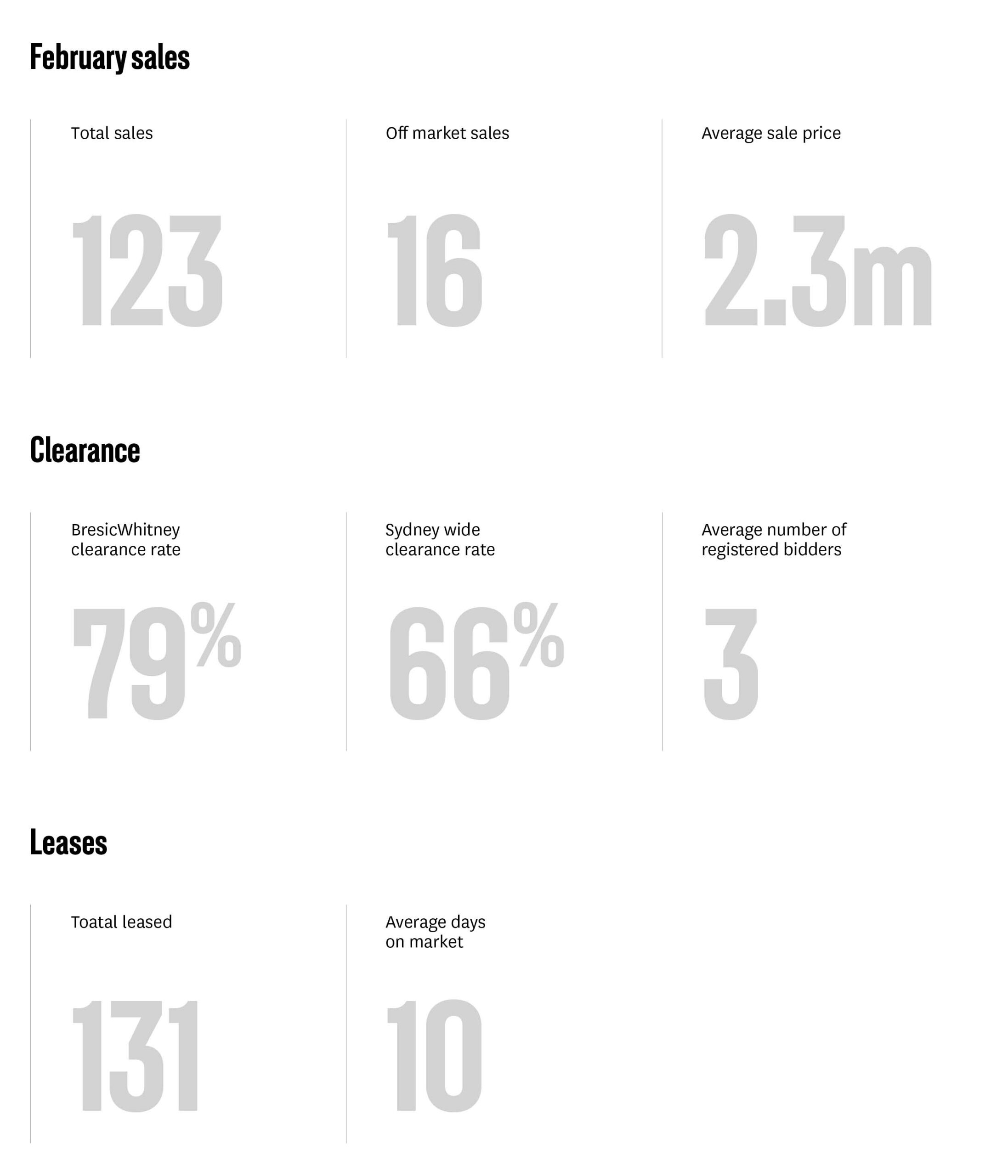

Interesting property market indicators were on show at the auction of 12 Myrtle Street, Chippendale this month. 5 bidders went head to head, 4 of them were investors.

We hadn’t seen such a strong turnout from speculators in some time, enticed back by rising rents and the value that typical houses have been presenting.

This sale was part of a wider trend in this unpredictable post-COVID market. First, it was family homes for sale, then the renter crowds trickled back. Could investors be about to follow?

At the same time last month we had a record average sale price at BresicWhitney – a clear sign that that the prestige and luxury market still continued above the rest.

According to the latest CoreLogic figures, Sydney home values fell 0.2% in March, taking home price growth over the quarter to 0.3% and the median value of homes in Sydney to $1.1 million, putting the city’s annual price growth at its slowest since March 2021.

Yet behind the scenes, little contradictions sent waves of demand towards our sales campaigns for standard apartments and small houses where prices were already in line with buyer expectations. And with some rental prices back to pre-COVID levels, yields were at their most attractive in more than 2 years.

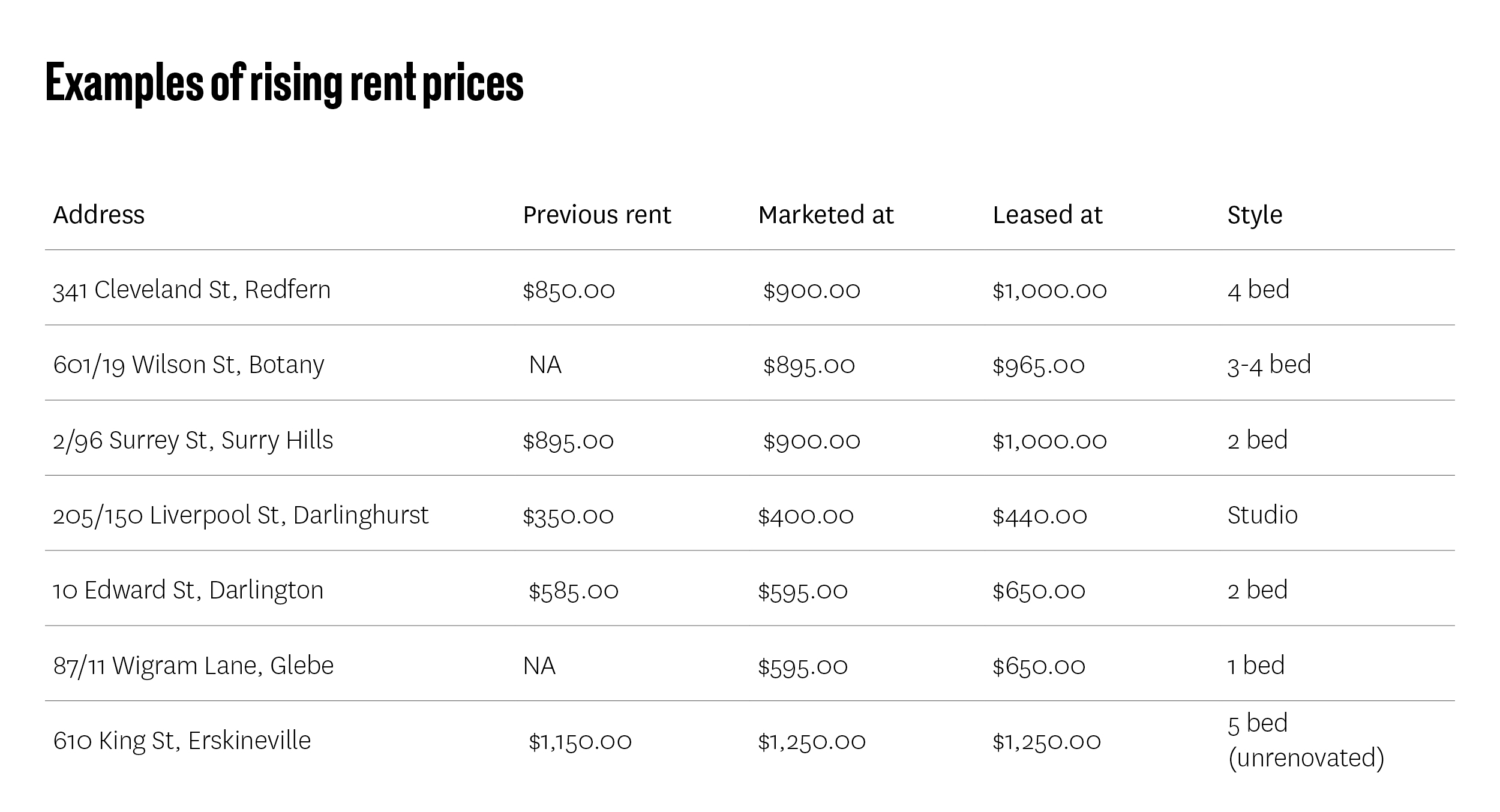

Head of Property Management, Chantelle Collin said this represented a huge turnaround for anyone caught up in the uncertainty of the past 2 years.

“We can’t get enough terraces in Paddington or stock-standard houses around the inner city to keep up with tenant demand,” Chantelle said. “We’re back to seeing 30 or 40 groups through some listings.

“Previously the focus has been on houses with more space, but now we’re seeing this spread across all types of properties.”

BresicWhitney’s rental vacancy rate nudged 7% during COVID, recently tightening to just 0.5%.

“We took what we learned during COVID and kept running with it,” Chantelle said. “That means ensuring our homes attract people by being vacant and ready, with top presentation, all set to lease.”

BresicWhitney CEO Thomas McGlynn said if positive signs persisted, he expected more investors would step in for this next phase of Sydney property.

“We’re not seeing a massive return of speculation just yet, but there is a change in sentiment that suggests it’s on the way,” Thomas said. “We often see people returning in small ripples before bigger waves of investors kick in.

“People are eying off enormous value in certain segments of the market, thinking it’s a great time to take advantage of the combination of lower interest rates and higher yields.

Many of the new rental patterns have reversed what we saw mid

pandemic:

— Supply is short because landlords sold up during the sales boom.

— Expats who moved home, now live in previously rented properties.

— People back in the CBD and young sharers are looking to rent again.

— Development has been slow and the cost of renovating is up.

Despite a slower momentum overall, many BW clients were convinced a new phase was just around the corner.

View all new listings here.

See all sold homes here.