Market Report: auctions are back

The market has changed in recent weeks.

Listings are up and buyers have become more spread out amid the growing stock levels. Looking at our listings, we’re up around 50% on the norm for the BW website, and a lot in our core suburbs too.

We haven’t seen things play out like this in a long time. Since 2016 it’s either been a buyers market or a sellers market. This feels like a new equilibrium, with our teams maintaining the momentum, as evident in our auction results.

In our first week back to public auctions last week, BresicWhitney saw 100% clearance on Saturday. Across Sydney that day, clearance rates were more like 76%.

At a time when many agents were becoming nervous about proceeding to auction, we were working with pre-qualified buyers, while encouraging our sellers to sell under the hammer. It was interesting to see a number of our sellers take that advice and hang in there until auction day.

This delivered a collective total of $1.7 million above our owners’ reserve prices on Saturday.

Last weekend we saw

- 60 registrations, an average of 6 per auction.

- 39 active bidders, an average of 4 per auction.

- 65% of registrations actively bidding.

And people are still buying because

- Home hunters are looking post lockdown.

- Interest rates are still at record lows (even if they’re tipped to rise).

- Builders are backed up, with people choosing upgrading over renovating.

Even though the market sentiment has been down in recent weeks with unfavourable media commentary, the properties we’re selling have been priced correctly, along with precise presentation, marketing, and networking between our offices.

With more balance in the market, people may see the remaining spring period as more of a fair playing ground for both buyers and sellers. If the familiar stresses of buying property in 2021 subside a little (after a run of skyrocketing prices), buyers on the sidelines may be more inclined to get involved.

We’ll be watching that, keeping you posted.

Recent highlight sales

138 Hereford Street, Forest Lodge sold above $4 million in an example of buyers moving between BresicWhitney offices. One agent introduced the buyer, another introduced the underbidder, and another team brought in a third registration. More than half of the bidders came from our networking, not our ads.

42 Station Street, Newtown was another sale at $3.1 million where an agent from another BresicWhitney office introduced the eventual buyer. More than four teams collaborated to show pre-qualified buyers around $3 million.

5 Nelson Street, Rozelle sold for $5.64 million in an impressive result for this area.

410 Moore Park Road, Paddington set a benchmark price of $9 million, showing the enduring demand for these wide residences in one of the area’s prominent rows.

The popularity substantial homes via our Hunters Hill office continued, 6 York Street, Gladesville was a classic untouched parcel on the edge of a park, sold for $3.95 million.

The rental space

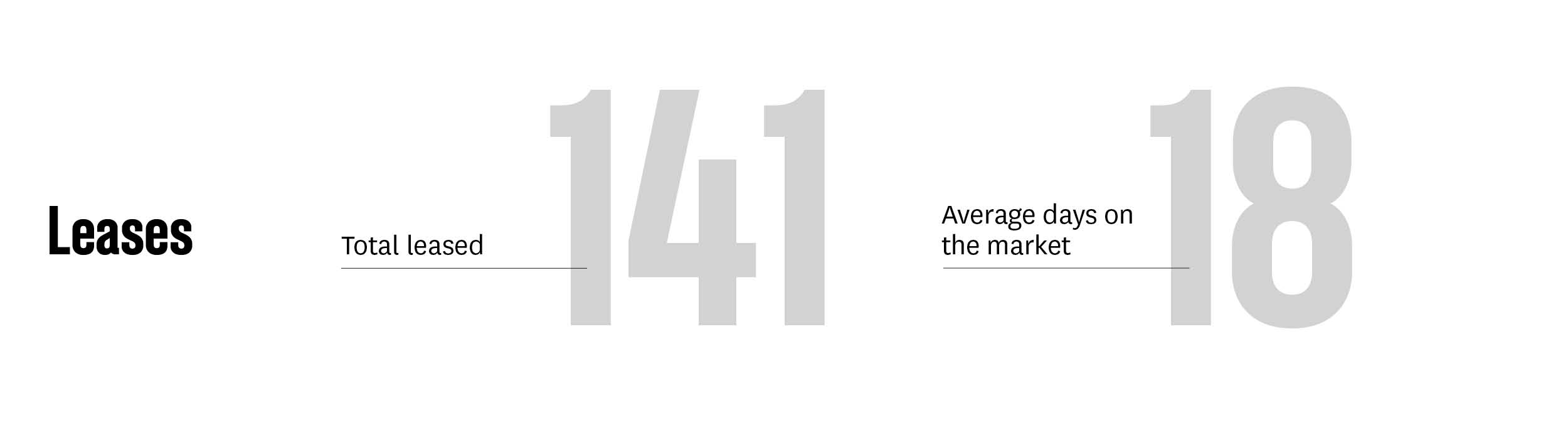

The rental market has enjoyed some reinvigoration during this post-lockdown month.

Our days-on-market number dropped considerably and our number of new leases was up.

BresicWhitney Head of Property Management Chantelle Collin said a record number of new people also joined our ecosystem as new clients.

“We’re seeing little pockets of demand, apartment-dense areas need to be sharply priced, and houses are still surging ahead,” she said.

“Our sales listings are full of great investment opportunities too.”

3 investment picks from Chantelle:

94 Ryde Road, Hunters Hill

“Live-now appeal. These houses easily rent. Growth potential up your sleeve on 488sqm.”

364-370 Cleveland Street, Surry Hills

“We never see 4 terraces in 1 line. Priced below individual averages. Long-term investing with upside.”

9/97 Curlewis Street, Bondi Beach

“An area where people are priced out of the house market. Ready-to-rent and the quality tenants want.”

See all new rental listings here.