Sydney’s ‘wait and see’ market

There has been a lot of talk about a cooling market and, at times, that sentiment shows. Yet sometimes the market has a mind of its own. Last month we saw many investors more concerned with budget announcements, reserve bank meetings and election bravado than actually buying property.

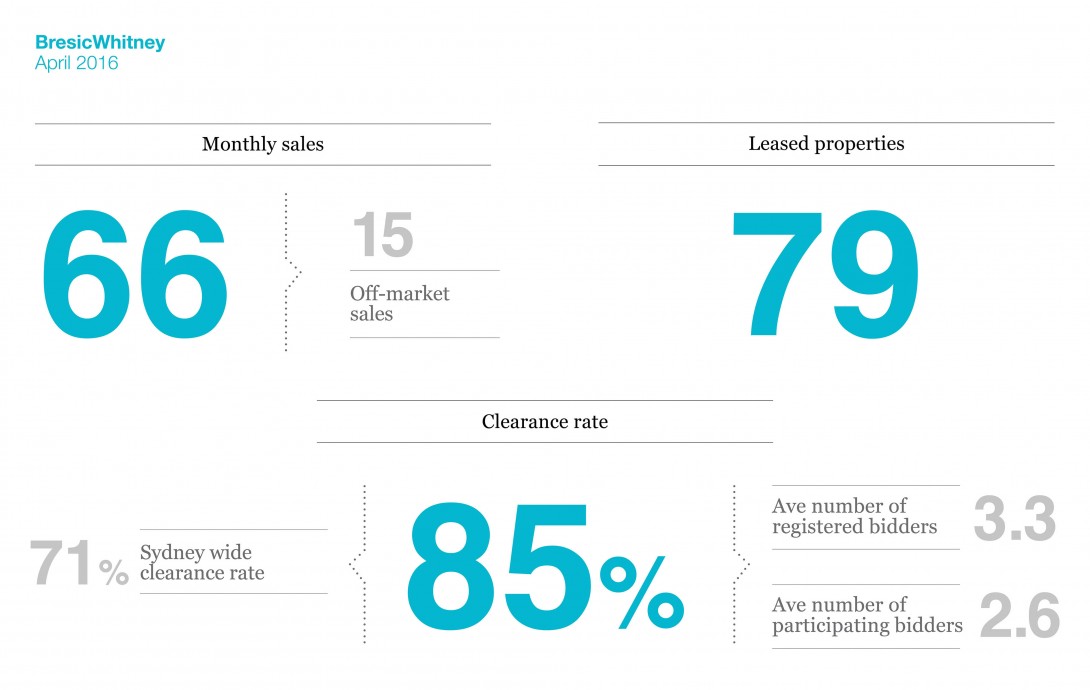

These people may be acting with less impulsiveness, but buyers are still seizing good opportunities when they see them. For example, more than 22% of April sales at BresicWhitney were via our ‘off-market’ platform (without traditional advertising, to pre-qualified buyers).

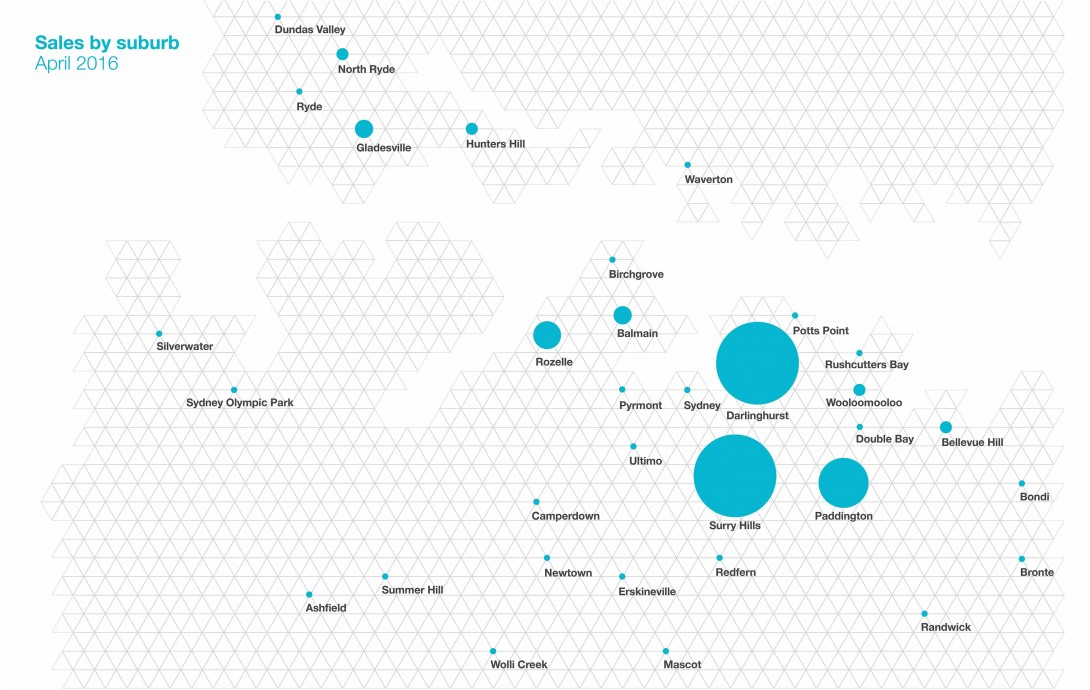

It was interesting to see this off-market activity experienced across a wide variety of property from a $600,000 Surry Hills’ apartment to a $4.8 million sale in Birchgrove. Our 66 sales kept BresicWhitney clearance rates steady at 85% while across the wider Sydney area, clearance rate averaged 71% for April.

This month still tracked close to our year-to-date clearance rate of 86%. With Sydney’s wider rate reportedly lower, it becomes important to follow the performance (or outperformance) of certain micro-markets against others.

Plenty of activity centred on the inner city. But sales from Bondi to Bronte and Double Bay drew interest. The Inner West was dotted with popular properties from Rozelle through Newtown/Erskineville to Summer Hill.

April rentals were slower with fewer people attending opens. Again, the urgency was absent from the marketplace. It meant potential tenants were enjoying the extra time to choose a new home. However, competitive pricing is still ensuring good properties move fast – leasing in the first or second week.