Sydney’s back in property mode ahead of spring

Sydney has switched into property mode again ahead of spring 2019.

With a positive tone underpinning current real estate media, we’ve seen an increase in open home attendance, inquiry, and listings.

According to CoreLogic figures, budding spring sellers still remain in a good position, with the number of new-to-market listings down 30% compared with this time last year, and the total stock on-market down 10%. And we’re seeing buyers respond to that.

In Annandale, one home was arguably the best residential example we’ve seen there. Trading off market, it set a new suburb record, and rightly so. Nearby, more than 150 groups turned out to the first open of this terrace in Newtown.

In Balmain, the archetypal peninsula house became sought-after again. We watched as offers crept back up towards seller’s expectations of $1.5 million for this classic. And we saw plenty of activity off the back of this momentum, including this one at 46 Elliott Street that sold in just five days.

As APRA lending restrictions relaxed, the AFR reported aspirational suburbs could be poised to get a boost from buyers who were previously priced out of the market. The prudential regulator has allowed banks to reduce their affordability buffers when assessing borrowers, reportedly bolstering some people’s borrowing power up to 20%.

In terms of prices, Sydney property had another modest increase in values of 0.2% for July. With values having already lifted in June (for the first time since 2017), there has now been tiny incremental increases in property value in Sydney for two months in a row.

Reporting on those figures, CoreLogic’s Tim Lawless said: “Leading up to June we were seeing improving rates of negative declines so I think the fact we saw a rise in June in Sydney and Melbourne and now a broad-based rise in July is really just a continuation of the trend we’ve been seeing. It’s also highlighting that the market is responding to some of the stimulus measures we’ve seen post May.”

“It’s not just about mortgage rates coming down and serviceability assessments being approved, we’ve also seen an improvement in confidence across the market, we’ve seen a lot of taxation reform removed and another factor that’s starting to wash through now is that listing numbers are dropping quite rapidly, so there’s not much stock out there in the marketplace, which means vendors are a little bit more empowered.”

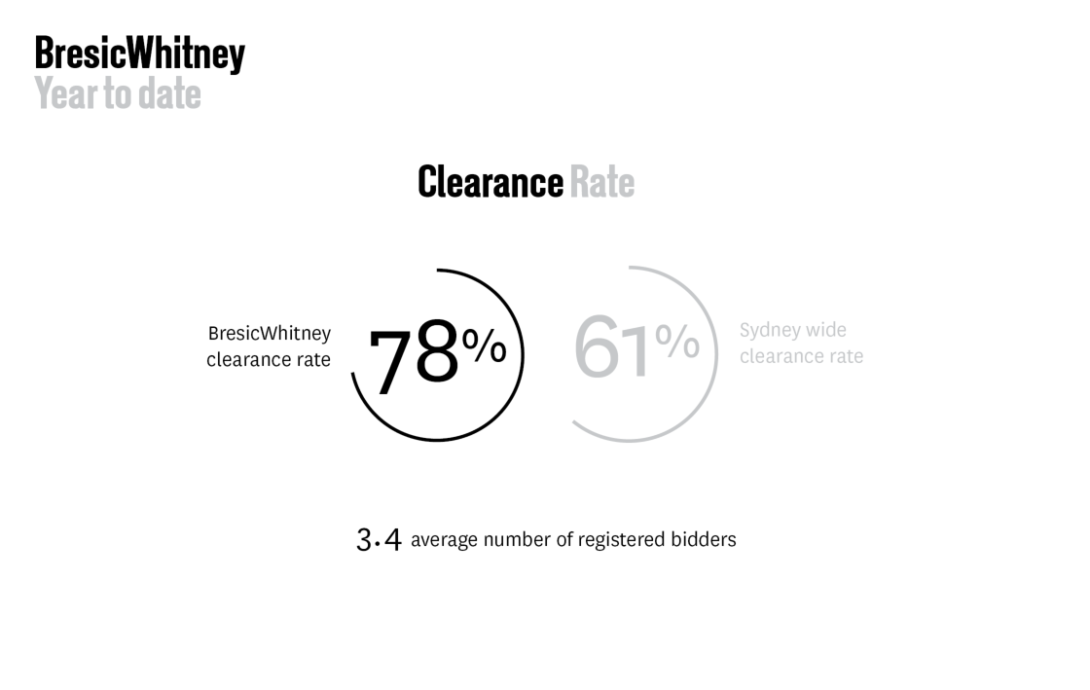

BresicWhitney, had 44 sales for July with all recent results found here. The July clearance rate at BresicWhitney was 80% with the wider Sydney figure coming in at 74%.

The BresicWhitney year-to-date clearance rate is 78% compared to the wider Sydney figure of 61%

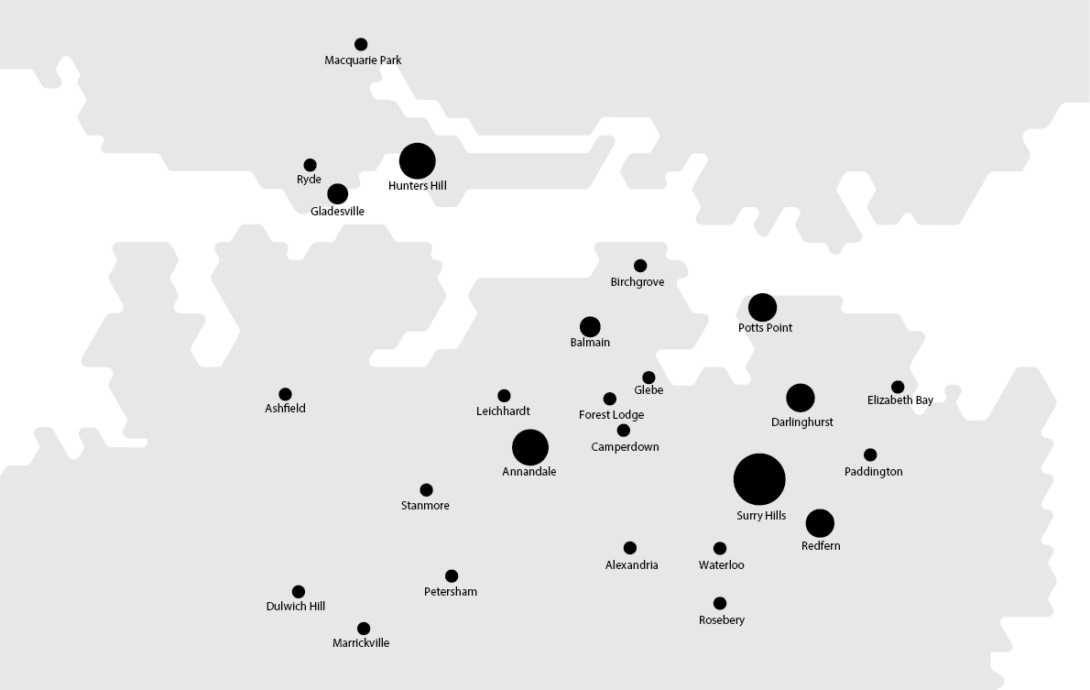

Sales activity were strongest in Surry Hills, Hunters Hill, Annandale and Redfern.

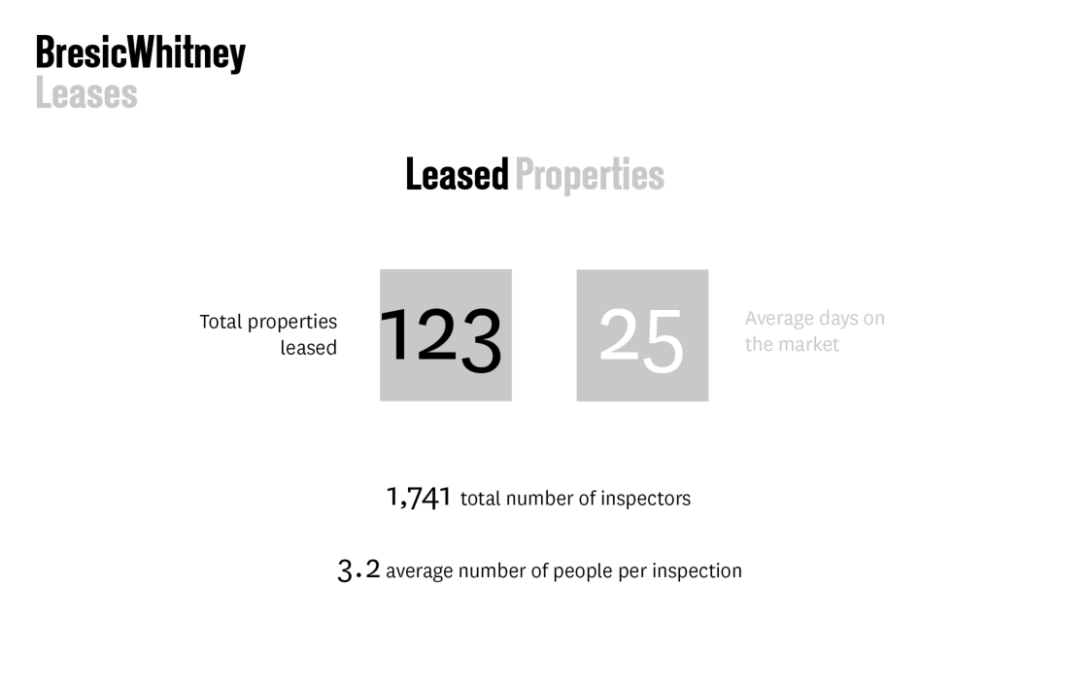

We’re leasing plenty of new properties but current home hunters are savvy, and owners are adjusting their expectations in line with what else is on the market. That extra attention to detail is what gets results.