Today, the day we’re waiting for?

In terms of news chatter and headlines, things took a turn this month. For the first time, analysts were talking about reasons the market might ‘bottom out’ or ‘recover’.

Those are terms we haven’t seen in a while.

There are a few reasons for their mood swing and it starts with today’s RBA rate announcement. Financial markets are backing a 50% prospect of a rate cut.

AMP economist Shane Oliver (known for his level-headed outlooks) told AFR the east coast housing market could hit an ‘early trough’ if that happens.

Some even predict two cuts this year. Others say interest rates will remain on hold.

An early recovery scenario was also discussed in the news against the backdrop of the election. Some tipped the market to fare better under a Coalition government.

Others predicted a Labor swing might spur some quick buying from investors, trying to lock-down investments before any tax changes.

It was also noted that the rate of market decline has started to slow. In January national home prices slipped 1%, in February 0.7%, in March 0.6%, and in April 0.5%.

Whatever your view, these are interesting times.

In terms of activity, an April filled with public holidays still brought results with 54 sales at BresicWhitney.

At the high end, buyers were quick to jump on homes of more than $3 million around Balmain and Hunters Hill.

At 10 Cove Street Birchgrove, a home sold for an undisclosed amount over $3 million after just 3 weeks on the market. An 1880s Victorian residence on one of Birchgrove’s top streets, people were attracted to its classic grandeur as much as its newer rear extensions.

Meanwhile someone hunting a substantial land parcel bought 2 Passy Avenue Hunters Hill for $3.65 million before that property ever hitting the open market.

Buyers have a number of reasons keeping them focused right now. Volume is down, new listings have been declining across Sydney, and the market has got 14.5% more affordable since the 2017 high.

That does make life easier for sellers at times, if they have an agent with a strong focus on buyers.

Agent Romany Brooks sold a property quickly off-market at 23 Little West Street Darlinghurst. With five buyers interested, four of them were personally introduced via other BresicWhitney agents.

The same happened at 3 Sims Street Darlinghurst where Nick Gill booked 19 private inspections off the back of sales at 42 Rainford Street Surry Hills, 140 Bourke Street Surry Hills and 11 Hegarty Street Glebe. The successful buyers were the first people to see it (at the photoshoot).

That saw BresicWhitney finish with 54 sales for April with a clearance rate of 74% (it was 59% across broader Sydney).

The BresicWhitney year-to-date clearance rate is 79% compared to the wider Sydney figure of 58%.

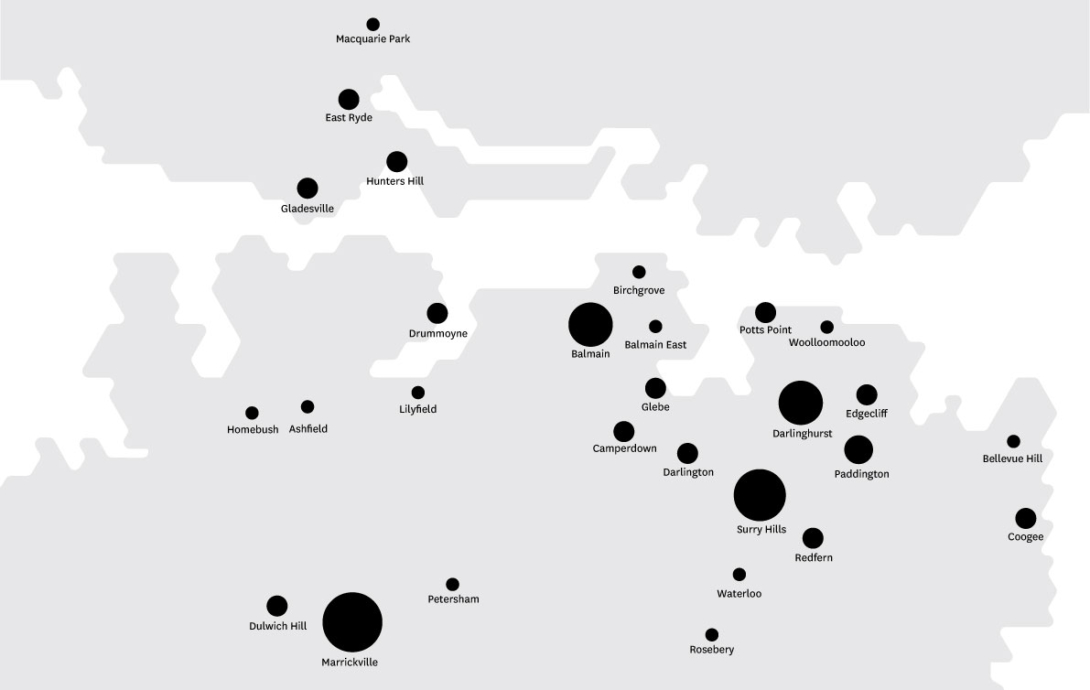

Sales were strongest in Marrickville, Surry Hills, Darlinghurst and Balmain.

The rental space was overshadowed by holiday breaks and plenty of tenants switching off, but we saw 115 new leases kick off during the April.

The market is still dominated by price with tenants picky about quality and a marketplace full of choice.