Clearance rates up! All good?

It was interesting to see little spikes in Sydney clearance rates this month. It had people asking why – ‘that’s good right?’

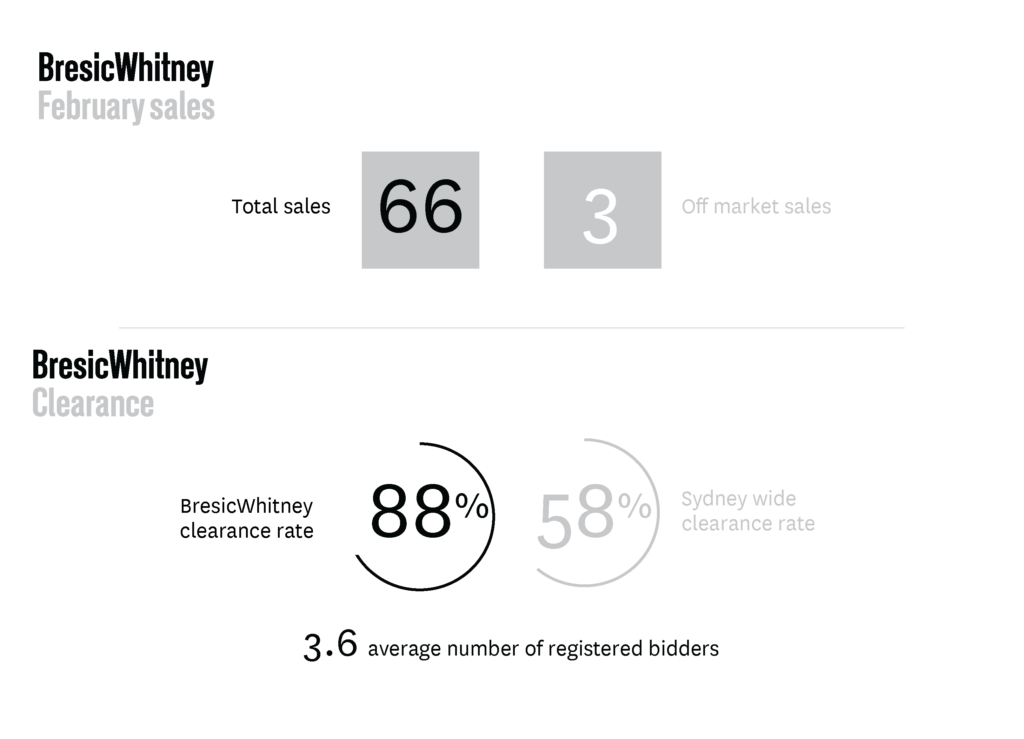

And BresicWhitney fared better with an 83% clearance rate compared to the wider Sydney figure of 58%. But let’s put things into perspective. 50 out of 60 auctions sold last month, but current market conditions continue.

Average prices across the city have dropped 13.2% from the July 2017 peak, according to monitors CoreLogic. In terms of peak-to-trough decline that’s the largest slip since at least the 1980s.

Anyone connecting stronger clearance rates to the possibility of better prices is sending a message of false hope. Solid clearance rates are definitely a sign of better execution of campaigns, and a selling approach that speaks to today’s market. And we’re seeing more awareness around prices, adaptability from sellers, and rationale in the market.

Amid all this, plenty of vendors are more pragmatic than the old Sydney expectations. That’s not to say they’re repeatedly cutting reserves, but they’re more calculated when shooting for an achievable price.

Another indicator people love are stock levels. CoreLogic says new listings are down (-20%), and that’s a good thing for sellers. But, remember, overall listings (with those sitting on the market) are up (20% on last year).

It’s no longer ‘bad’ or ‘good’ out there. It’s just different. And buyers and sellers are trying alternate approaches, and having new dialogues.

The better question might be, ‘what will it take to get me a result in today’s conditions?’

BresicWhitney saw 66 sales last month, for a steady and measured February.

Sales were strongest in Surry Hills, Redfern, Balmain and Leichhardt, and we saw a monthly average of 12 groups through each inspection.

On the rental scene we leased 125 properties with a slightly lower days-on-market figure. Homeowners are being realistic with their terms and responding quickly to good applicants.

We’re seeing one-off apartments and house packages lease faster, with people less inclined to act quickly for stock-standard offerings.